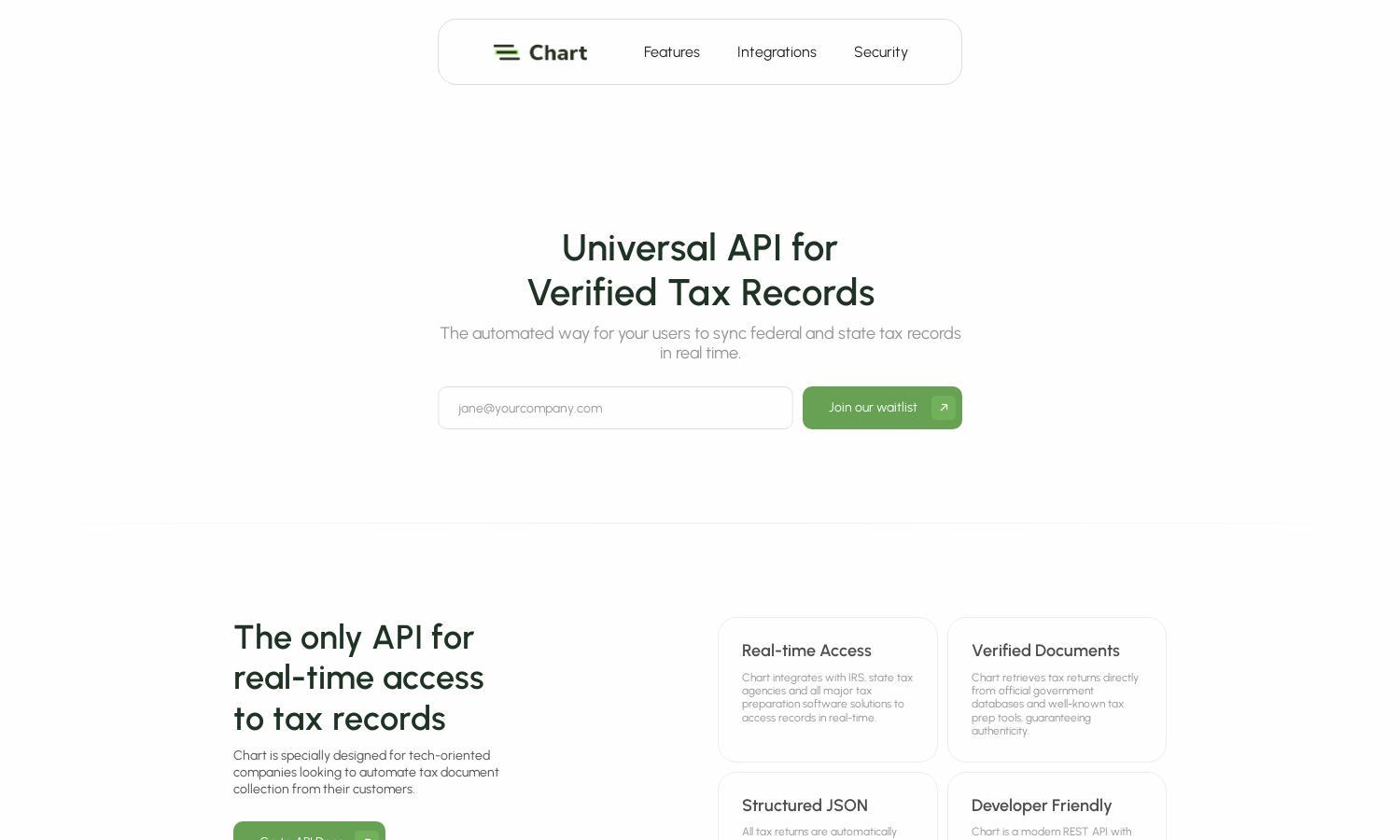

Chart

About Chart

Chart is a universal API that allows tech-oriented companies to easily access verified tax records in real-time. It successfully integrates with IRS and state agencies to streamline tax document collection. Users benefit from developer-friendly tools and enterprise-grade security features, solving inefficiencies in tax retrieval processes.

Chart offers flexible pricing plans tailored for different business needs, providing access to features that enhance tax document collection and verification. Subscriptions include a range of benefits, with discounts available for larger teams, encouraging users to upgrade for expanded access to the unique capabilities of Chart.

The user interface of Chart is designed for optimal usability, featuring an intuitive layout and streamlined navigation. Users can effortlessly access tools and resources, enhancing their experience. Unique features facilitate real-time access to tax records, ensuring an efficient and user-friendly exploration of Chart’s services.

How Chart works

Users begin with a straightforward onboarding process that guides them through creating an account on Chart. Once registered, they can connect their tax accounts or upload documents directly. The platform then processes documents using OCR technology, presenting them in well-structured JSON formats, enabling seamless interaction and efficient retrieval of verified tax records.

Key Features for Chart

Real-time Access

The real-time access feature of Chart stands out, allowing users to instantly retrieve verified tax records from the IRS and state agencies. This unique functionality streamlines document collection processes, ensuring that tech-oriented companies receive accurate and timely information necessary for their operations.

Verified Documents

Chart's verified documents feature enhances user trust by retrieving tax returns directly from official databases. This capability ensures authenticity and reliability, making Chart a go-to resource for tech companies seeking secure access to verified tax records, ultimately protecting user data and improving compliance.

Developer Friendly

Chart is designed to be developer-friendly, offering modern REST APIs with comprehensive SDKs across major programming languages. This distinct feature, along with its extensive documentation and sandbox environments, ensures that developers can integrate the Chart API seamlessly, facilitating rapid deployment and usage.

You may also like: