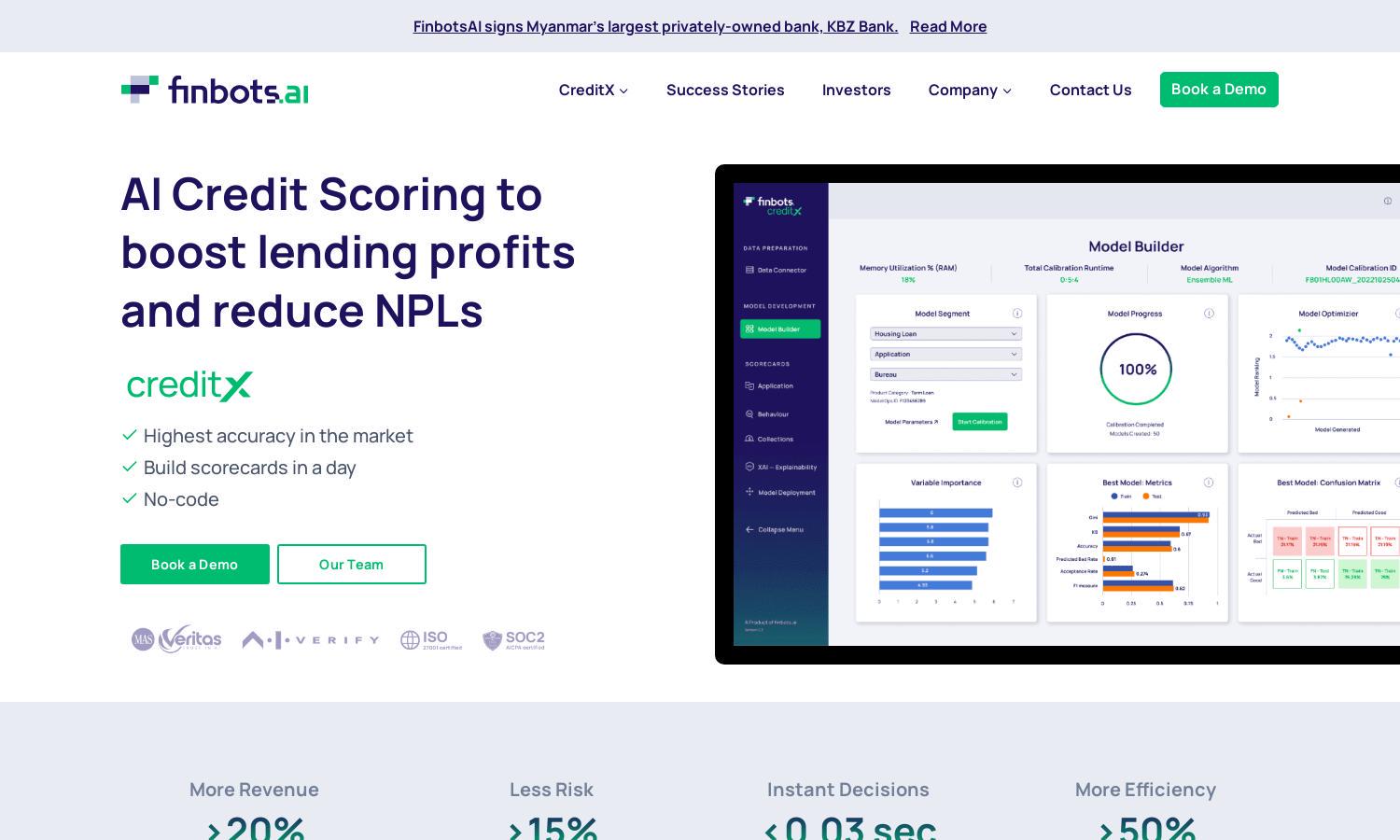

finbots.ai

About finbots.ai

Finbots.ai is a leading AI-powered credit risk platform, specializing in CreditX, which enables lenders to build custom scorecards effortlessly. Designed for financial institutions seeking efficiency, it provides high accuracy in decision-making and rapid deployment capabilities, addressing the critical need for improved credit risk management in lending.

Finbots.ai offers competitive pricing on its CreditX platform with flexible subscription tiers. Users can benefit from 30% off for the first six months, leading to a cost-effective strategy for lenders aiming to boost their credit scoring and approval processes without compromising on efficiency or effectiveness.

The user interface of finbots.ai is designed for seamless navigation, allowing users to access core functionalities effortlessly. Its clean layout ensures that users can easily build and deploy scorecards, enhancing the overall experience while maximizing productivity. Finbots.ai emphasizes accessibility and user-friendly features within its platform.

How finbots.ai works

Users begin by signing up for finbots.ai, where they are guided to connect their internal, external, and alternate data sources. They can effortlessly create high-accuracy credit scorecards using the platform's proprietary AI technology, which automatically builds, validates, and deploys models. Real-time decision-making enables efficient lending processes, making finbots.ai a transformative tool for credit risk management.

Key Features for finbots.ai

Custom Scorecards

Finbots.ai's custom scorecards are a standout feature, allowing lenders to efficiently tailor credit assessments to their unique needs. Users can create personalized, high-accuracy scoring models quickly, accelerating the lending process and improving decision quality, making finbots.ai an indispensable tool for effective credit risk management.

Rapid Deployment

Finbots.ai boasts rapid deployment capabilities, empowering lenders to launch credit scorecards in just hours. This swift implementation not only reduces operational downtime but also allows financial institutions to respond dynamically to market needs, enhancing their competitive edge and profitability in lending practices.

Real-Time Decisioning

Finbots.ai incorporates real-time decisioning within its platform, enabling lenders to make instantaneous credit assessments. This feature significantly reduces response times and enhances customer satisfaction, streamlining the lending process by ensuring swift, accurate decisions that meet the immediate needs of borrowers.

You may also like: