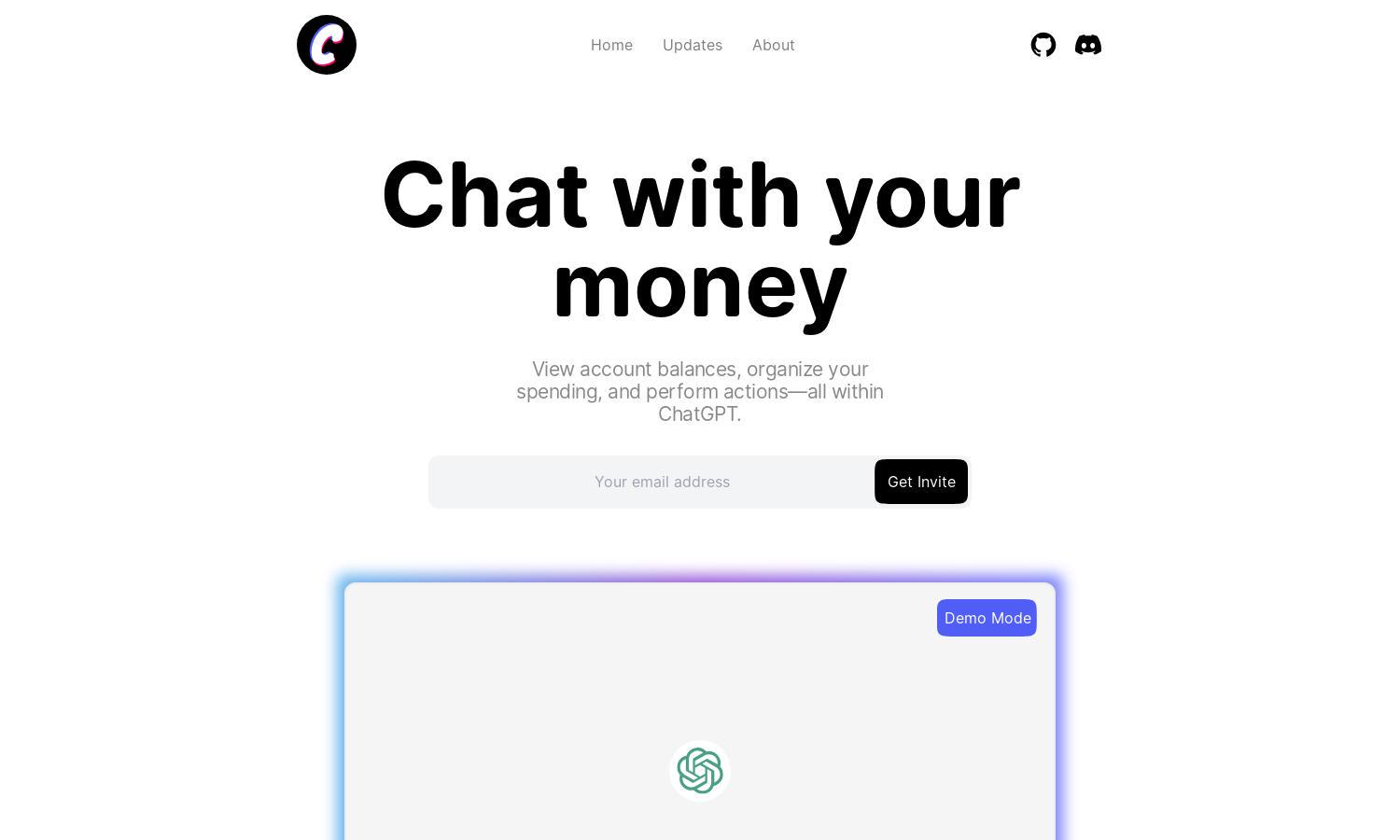

Candle GPT

About Candle GPT

Candle GPT is an innovative financial management tool designed for users to interact directly with their financial accounts via ChatGPT. With secure connections to accounts, users can monitor balances, organize spending, and automate transactions, making personal finance management simpler and more effective.

Candle GPT currently offers free access to its features, with future plans for subscription-based pro features. Upgrading to a subscription will unlock advanced functionalities while ensuring user privacy and data security are prioritized. As a user, you can enjoy enhanced financial management capabilities.

Candle GPT features a user-friendly interface designed for ease of navigation. The layout allows intuitive access to various financial tools, ensuring a smooth experience for managing accounts and transactions. Engaging elements enhance user experience, making Candle GPT approachable for all users.

How Candle GPT works

To use Candle GPT, users begin by downloading the Candle app on iOS or Android. After onboarding, users securely link their financial accounts, ensuring that credentials remain private. Once set up, users can chat with Candle GPT to check balances, make transactions, and manage investments seamlessly.

Key Features for Candle GPT

Secure Account Linking

Candle GPT's secure account linking allows users to connect their financial accounts safely, ensuring data integrity and privacy. The platform enables immediate access to account balances and spending history, enhancing financial visibility and control over personal finances for users.

Automated Financial Transactions

Candle GPT's automated financial transactions empower users to execute payments, transfers, and investments effortlessly. This feature simplifies money management, allowing users to focus on their financial goals while the platform handles routine transactions efficiently, ensuring a hassle-free experience.

Personalized Financial Insights

Candle GPT offers personalized financial insights tailored to individual spending habits and goals. Users receive data-driven advice on optimizing their finances, fostering better financial decision-making and an overall improved understanding of their financial situations.

You may also like: